how to file back taxes without records canada

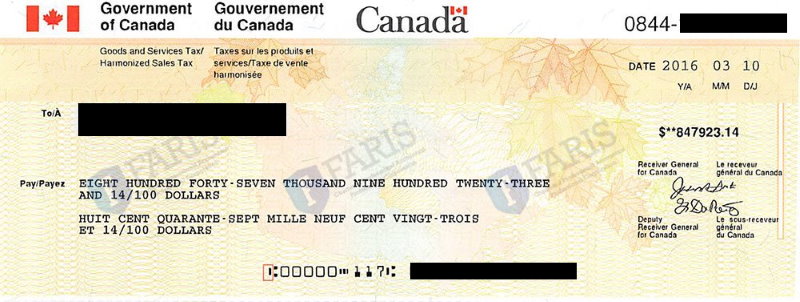

Youre required to file a tax return in the year you leave Canada if you have a tax balance owing or youd like to receive a tax refund. You must have the.

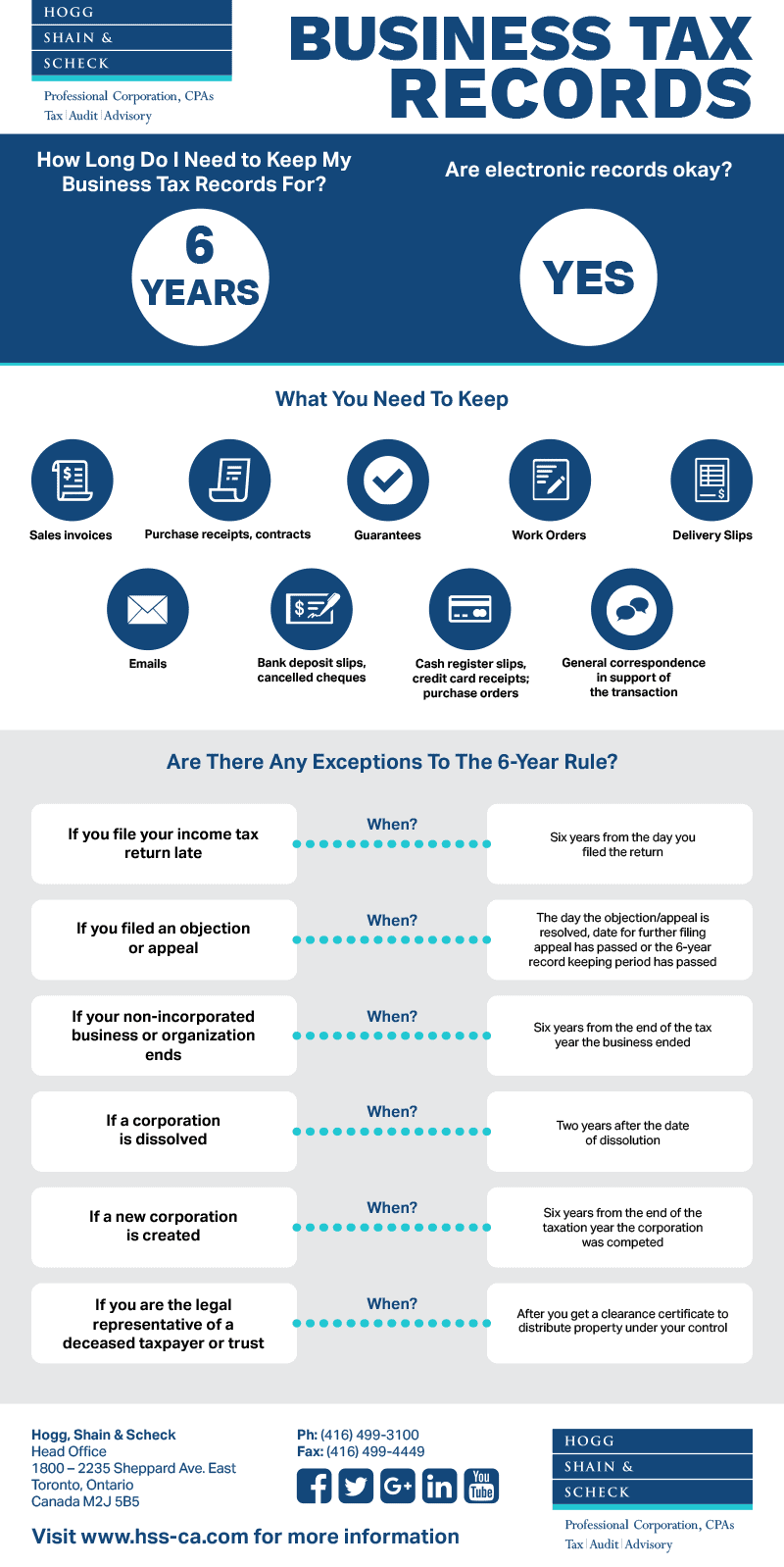

How Long Do I Need To Keep My Business Tax Records For Are Electronic Records Okay What You Need To Keep Are There Any Excepti

This is true even if you already missed returns for couple of years.

. We Can Help Suspend Collections Liens Levies Wage Garnishments. The first step is gathering any information from the. Its only illegal when you receive a request to file or youre taxable and you dont file.

Prepare the tax return from the clients documents. To finally be free from stress caused by your tax problems you would need to first file all your back taxes. If you are missing any slips or are unsure if you have them all you.

This an affordable option to hiring a tax accountant. If you need wage and income information to help prepare a past due return complete Form 4506-T. Below are actionable steps you can take to avoid joining issues with the CRA.

Ensure to complete and get your client to sign a Form T183 Information Return for Electronic Filing of an Individuals. The penalty for filing taxes late is 5 of the tax years balance owing plus 1 of the balance owing for each full month your return is late up to a maximum of 12 months. We Can Help Suspend Collections Liens Levies Wage Garnishments.

If you file an income tax return late you must keep your records for six years from the date you file that return. For 2019 this penalty is 5 of the balance owing plus 1 for every month you were late to a. You should take special.

If you filed your tax return after the filing deadline CRA charges a late-filing fee. Back tax returns at a glance. Contact us today for a confidential non-judgemental no charge no.

To File or Not File a Tax Return. Our experienced group of professionals has helped thousands of clients many of whom have been clients for years. For filing help call 1-800-829-1040 or 1-800-829-4059 for TTYTDD.

If you have not filed a GSTHST return for a reporting period that ended more. Ad Get Back Taxes Help in 3 Steps. However this is only the.

For personal returns you will need any and all T-slips such as T4s and T5s. Filing a tax return for a previous year isnt as hard as you may think but it does require a few steps. However to properly use tax accounting software and learn how to file back taxes without records.

Not filing a required return is a serious issue with the IRS. Ad Get Back Taxes Help in 3 Steps. If you dont file the IRS can file a return for you with taxes and penalties.

Filing Back Taxes And Old Tax Returns In Canada Policyadvisor

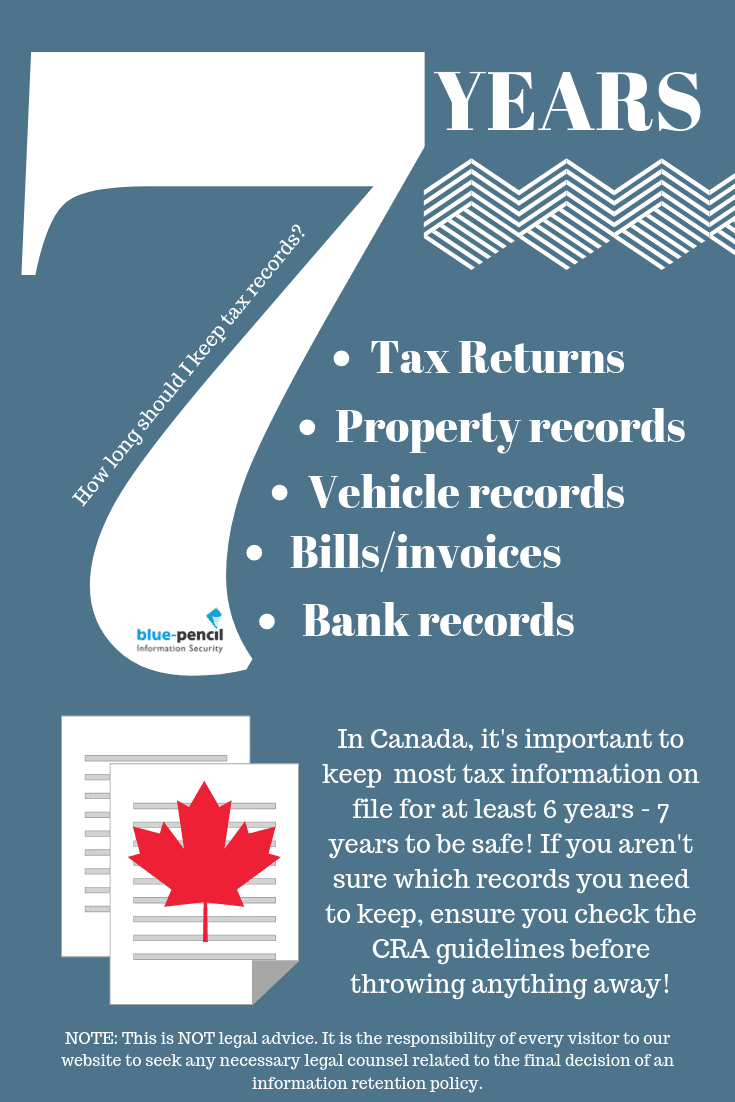

Tax Records How Long To Keep Them To Be Safe

When Is It Safe To Recycle Old Tax Records And Tax Returns

Tax Season Shredding What To Keep How Long Shred Nations

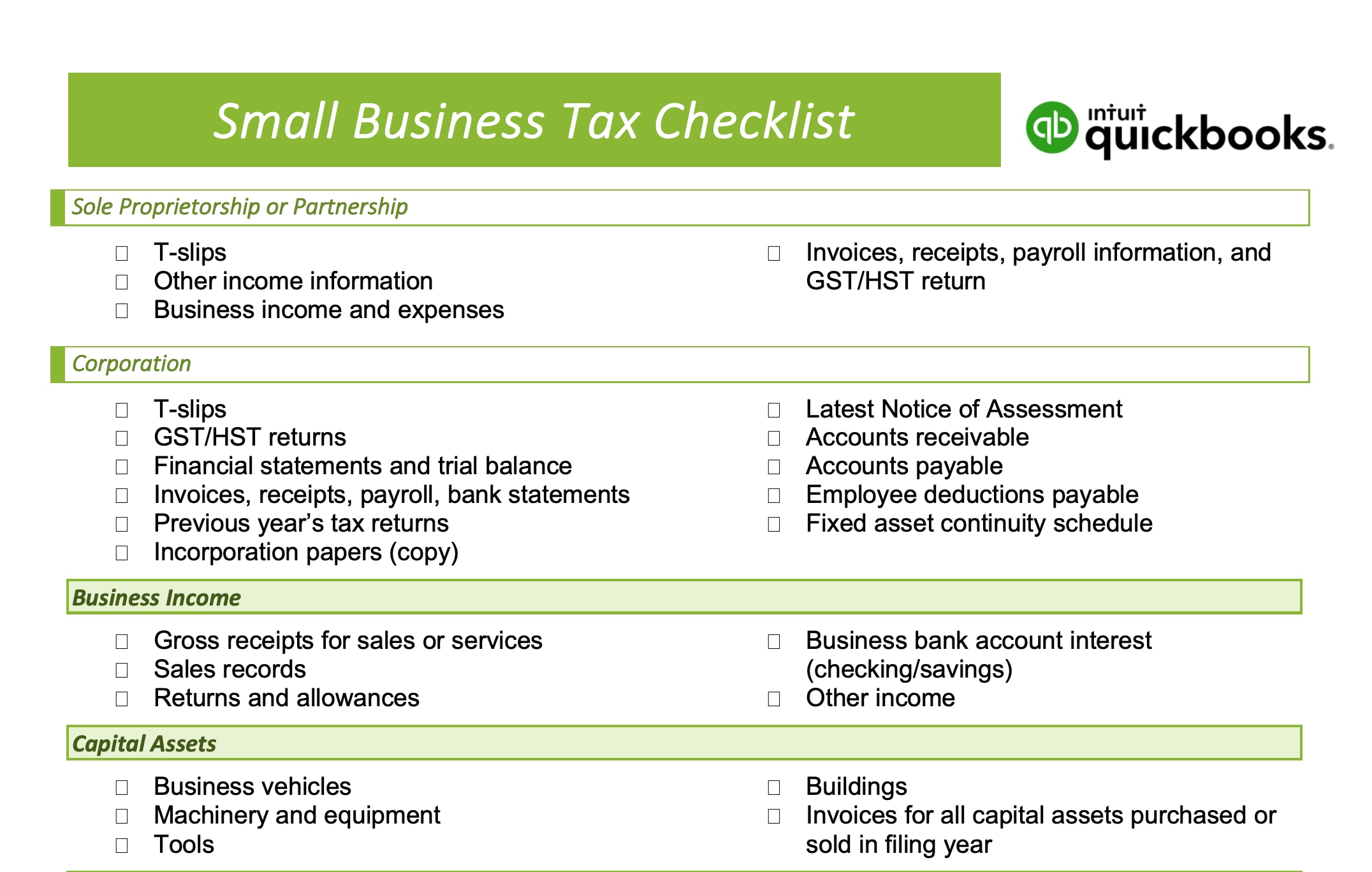

How To File Small Business Taxes Quickbooks Canada

How Long To Keep Tax Records In Canada Why

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Tax Season Shredding What To Keep How Long Shred Nations

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Income Tax Return Income Tax How To Get Money

Mak Financials Audit Services Business Tax Retirement Strategies

Notice Of Assessment Reassessment Everything To Know Kalfa Law

How Long To Keep Tax Records In Canada Why

Cra Tax Audit In Toronto Toronto Cpa

How Long To Keep Tax Records In Canada Why

The Real Cost Of Not Paying Your Taxes On Time 2022 Turbotax Canada Tips

Your Income Tax Return And Supporting Documents 2022 Turbotax Canada Tips